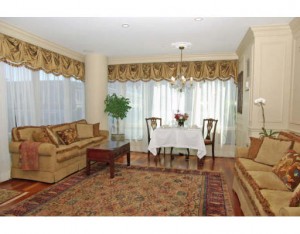

Bryant Back Bay

Just to give everyone a little perspective on the current condo market in Boston, MA, here is a true story….Thursday, a new listing at the Bryant Back Bay came on the market for $1,794,000+$140,000 for a second garage space. Well, based on the feedback, the auction sale prices are in the rear view mirror.

Saturday there were 5 showings, Sunday Open House had 16 groups come through, Monday morning saw 5 more groups come through and unit went Under Agreement Monday afternoon.

Lesson Learned: The luxury condo market is heating up FAST. For units to be flying off the market this fast in early February is a pretty clear indication that the Spring market is going to be very strong. Buyers need to be ready to act if the right opportunity presents itself.

*The best advice we can give you is to find a good Buyer’s agent, preferably from LRG;-), who will monitor the market on a daily basis and notify you when your ideal home comes on the market.

Yes, it is true….parking just went up in Boston 25% from $2.00 to $2.50 for two hours of parking, $1.25/hour or 12 minutes for $.25. I am sure a lot of you were wondering why the machines were taking more of your money. Here is your answer.

Yes, it is true….parking just went up in Boston 25% from $2.00 to $2.50 for two hours of parking, $1.25/hour or 12 minutes for $.25. I am sure a lot of you were wondering why the machines were taking more of your money. Here is your answer.